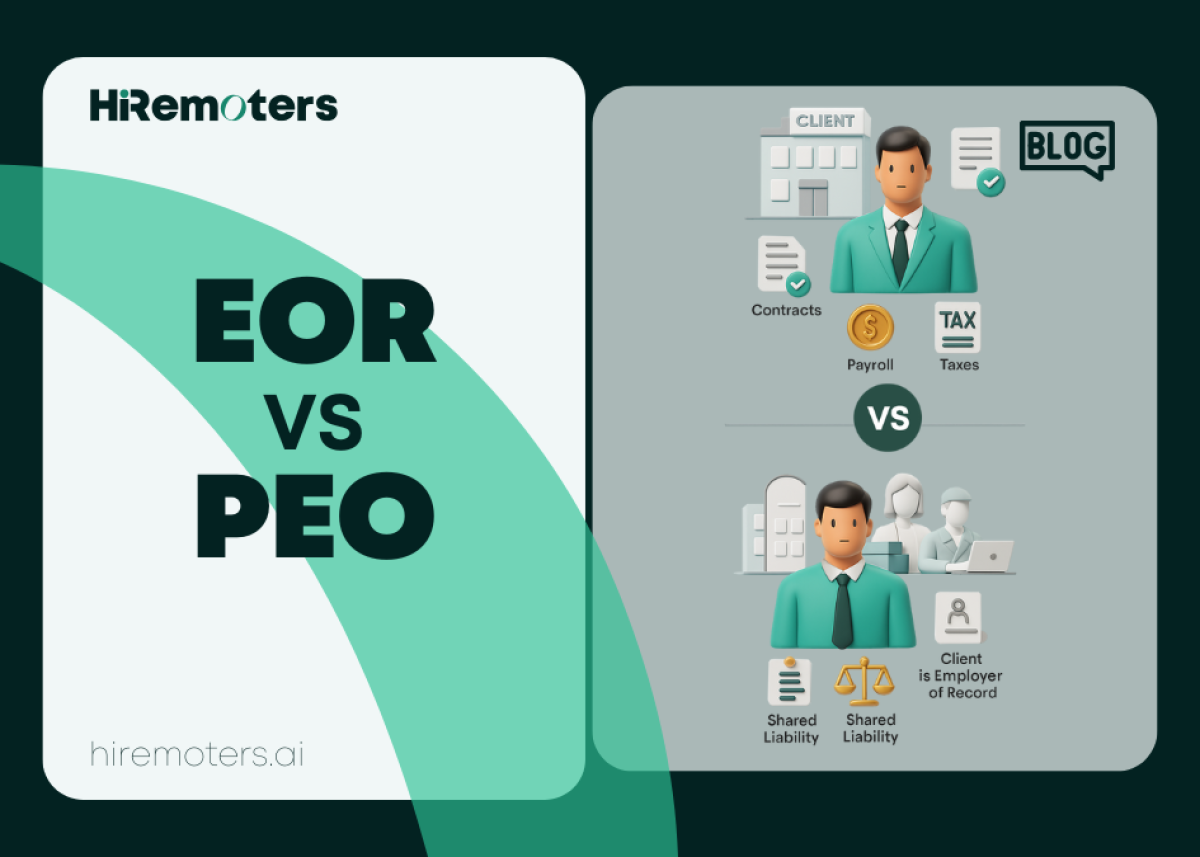

When expanding your business internationally or managing a remote workforce, you may come across terms like EOR (Employer of Record) and PEO (Professional Employer Organization). Both offer valuable solutions for global hiring and HR management, but they serve different purposes and operate in distinct ways.

In this article, we will break down the key differences between EOR vs PEO, helping you decide which is best for your company's needs. Whether you’re exploring global employment solutions, international workforce management, or simply want to understand what EOR and PEO, this guide will provide clear answers.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a service that legally employs workers on behalf of your company in another country. The EOR handles all compliance, payroll, taxes, and labor law requirements, allowing your business to hire employees abroad without setting up a local legal entity.

Key Features of EOR Services:

- Legal employment: The EOR is the official employer of your workers.

- Compliance management: Ensures local labor laws, tax regulations, and benefits are handled correctly.

- Payroll and taxes: Manages salary payments, tax deductions, and social security contributions.

- Onboarding and offboarding: Takes care of hiring, contracts, and termination procedures.

- Global hiring made easy: Allows businesses to hire anywhere without registering a local branch.

Many companies use an EOR to quickly access international talent and streamline their remote workforce management while staying compliant with local regulations.

What is a Professional Employer Organization (PEO)?

A Professional Employer Organization (PEO) is a service that co-employs workers alongside your company, primarily in your home country. The PEO manages HR functions such as payroll, benefits, workers’ compensation, and compliance, while you maintain operational control over your employees.

Key Features of PEO Services:

- Co-employment model: PEO and your company share employer responsibilities.

- HR administration: Handles payroll, benefits administration, and risk management.

- Compliance support: Helps you navigate employment laws and workplace regulations.

- Employee benefits: Offers access to group health insurance and retirement plans.

- Workforce management: Focuses on domestic employment and employee support.

PEOs are ideal for small to medium businesses looking to outsource HR functions domestically, improve employee benefits, and reduce administrative burdens.

EOR vs PEO: What Are the Main Differences?

Understanding the differences between EOR and PEO is crucial for selecting the right partner for your business. Here’s a side-by-side comparison:

When to Use an EOR?

Using an EOR is an excellent choice if your company:

- Wants to hire employees in foreign countries quickly without establishing a legal presence.

- Needs to ensure full legal compliance with local labor laws and tax regulations.

- Is testing a new international market and wants to avoid the risks and costs of a local entity.

- Prefers an all-in-one solution that covers onboarding, payroll, benefits, and compliance.

- Needs to hire remote workers across multiple countries with minimal setup.

Example Use Cases for EOR:

- A U.S.-based tech startup is hiring software engineers in Germany, Brazil, and Japan.

- A multinational company onboarding sales reps in new international markets.

- A business expanding operations into countries with complex employment laws.

When to Use a PEO?

A PEO is a better fit when your company:

- Operates primarily in one country and wants to outsource HR administration domestically.

- Seeks to offer competitive employee benefits like health insurance, 401(k), and workers’ comp.

- Wants to reduce administrative overhead by outsourcing payroll, tax filing, and compliance.

- Is looking for expert guidance on local employment regulations.

- Wishes to improve employee satisfaction with professional HR support.

Example Use Cases for PEO:

- A small business in the U.S. needing payroll, benefits, and HR management.

- A growing company that wants to access group health insurance plans.

- A firm wanting to reduce risks related to employment law compliance.

EOR vs PEO: Cost Comparison and Contract Terms

Costs and contract terms vary widely between EOR and PEO providers, depending on the services offered and locations covered.

EOR Cost Structure:

- Typically charges a percentage of each employee’s salary (commonly 10%-20%).

- May include setup fees or monthly minimums.

- Costs reflect the added complexity of international compliance.

PEO Cost Structure:

- Often charges a flat fee per employee or a percentage of total payroll (about 2%-12%).

- Pricing depends on services like benefits administration and risk management.

- Generally, it is more cost-effective for domestic HR outsourcing.

When comparing providers, consider:

- The scope of services included (payroll, benefits, compliance).

- The countries covered if using EOR for global hiring.

- The flexibility of contracts (length, termination clauses).

- The quality of customer support and technology platforms.

How to Choose Between EOR and PEO?

To select the right option for your business, answer these questions:

- Where are your employees located?

- If international, EOR is usually necessary.

- If domestic, a PEO is often sufficient.

- Do you have or want a legal entity in the employee’s country?

- Without a local entity, an EOR provides a legal hiring solution.

- With a local entity, a PEO can co-employ your staff.

- What level of compliance support do you need?

- For full compliance outsourcing, EOR is ideal.

- For shared compliance responsibility, a PEO fits.

- What’s your budget and HR complexity?

- EOR can be costlier but offers end-to-end solutions abroad.

- PEOs are typically more affordable for domestic HR functions.

- Are you expanding into multiple countries or just managing a local team?

- Use EOR for global, multi-country hiring.

- Use PEO for domestic workforce management.

Advantages and Disadvantages of EOR and PEO

Pros of EOR:

- Enables fast global hiring without legal entity setup.

- Ensures full compliance with complex international laws.

- Simplifies payroll and benefits management globally.

- Reduces legal risk related to employment.

Cons of EOR:

- Can be more expensive than PEOs.

- Less direct control over employee contracts.

- Limited customization in some regions.

Pros of PEO:

- Offers cost-effective HR outsourcing domestically.

- Provides access to group employee benefits.

- Helps companies stay compliant with local regulations.

- Improves employee experience with HR support.

Cons of PEO:

- Limited to countries where your company has legal presence.

- Shared employment responsibilities can be complex.

- Less suited for global expansion.

Common Misconceptions About EOR and PEO

- Misconception 1: EOR and PEO are the same. They serve different markets and employment models. EOR focuses on international hiring, while PEOs serve domestic HR needs.

- Misconception 2: EOR means losing control over employees. The client company retains day-to-day management; the EOR handles administrative and legal aspects.

- Misconception 3: PEOs only handle payroll. PEOs provide a full range of HR services, including compliance, benefits, risk management, and employee support.

Final Thoughts on EOR vs PEO

Choosing between an Employer of Record (EOR) and a Professional Employer Organization (PEO) depends largely on your business’s location needs, compliance requirements, and budget. For international expansion and hiring without legal entities abroad, EOR is the practical solution. For domestic HR outsourcing, PEOs offer cost-efficient, comprehensive services.

Investing time to understand the nuances of EOR vs PEO will save your company from costly legal mistakes and help streamline workforce management, whether local or global.

Build, Scale, and Manage Your Global Teams with HiRemoters

Whether you're growing globally or managing local teams, HiRemoters makes HR and payroll seamless across regions, time zones, and every step of the way with the support you can count on.